Financial Aid Mistakes that Healthcare Students Make

Share

Financial Aid Mistakes that Healthcare Students Make

If you’re training to become a nurse, pharmacist, doctor, or other healthcare professional, you’ve already taken on one of the most important — and expensive — learning challenges out there. And when you add financial aid to the mix of caffeine, heavy books, and exhausting clinicals… suddenly, things can feel overwhelming fast. If student loans, grants, and paperwork make your head spin, don’t miss out on these valuable resources (or fall into these costly traps).

Skipping the FAFSA or Filing It Late

The Free Application for Federal Student Aid — better known as the FAFSA — is your golden ticket to grants, scholarships, work-study, and federal loans. Yet every year, thousands of healthcare students either forget to file it or wait too long and miss out. Even if you think you won’t qualify for aid because your income is too high (or your parents’ income is), it’s still worth filing.

Some schools require the FAFSA just for scholarship consideration. Plus, the sooner you submit it, the more aid you’re likely to get — funds can run out! Different states, schools, and scholarships have their own submission deadlines each year. You can use studentaid.gov to search for your dates and set a calendar reminder to file your FAFSA as soon as it opens.

Borrowing More Than You Need — and Paying for It Later

Student loans can feel like fake money when you’re juggling anatomy labs and 12-hour shifts. But the fact is, financial aid isn't always free money (such as grants and scholarships). Loans have to be repaid with interest — the fee you pay for borrowing money.

A common mistake you can avoid is accepting the full loan amount offered, even when you don’t need that much. It can be tempting, but a few thousand dollars here and there can turn into tens of thousands in interest by the time you're ready to start paying it back. Instead, look carefully at your real costs — tuition, housing, books — and see where you can cut back. Could you work a few hours a week, live with roommates, or buy used textbooks? Borrow only what you actually need to stay focused on school without financial stress.

Overlooking the “Free Money”: Scholarships and Grants

Many healthcare students get tunnel vision around loans and forget an important fact: not all financial aid needs to be paid back. Scholarships and grants can make or break a semester, and they’re everywhere if you know where to look. From small local hospital foundations to big national organizations, many offer scholarships for nursing, pharmacy, physician assistant, and med students. Some even focus on specific specialties, like pediatrics or rural medicine.

The catch: you have to find them and apply! Set a goal to apply for at least 3–5 scholarships every semester, even once you're already in school. It may feel like extra work now, but this is the best time in your life to get money handed to you without expectation for return.

Forgetting to Budget and Track Spending

Even if you’ve filed your FAFSA and won a scholarship or two, finances can still spiral if you don’t stay on top of your budget. Many students make the mistake of thinking their loan balance will magically stretch — until they hit the final semester and realize they’re short. Basic budgeting may not be as exciting as suturing your first wound or nailing a care plan chart — but it’s just as important for your success.

- Use a simple spreadsheet to track your income, expenses, and remaining aid.

- Break your semester loan disbursement into monthly chunks and save it.

- Avoid blowing through cash too fast and running into ramen-only weeks before finals.

Missing Loan Forgiveness Opportunities

If you’re going into healthcare, there may be ways to have a portion of your student loans forgiven — but only if you meet certain criteria and stay on track. And many students don’t learn about options like Public Service Loan Forgiveness (PSLF) until it’s too late.

- PSLF is designed for those working in nonprofit or government healthcare organizations. If you make 120 qualifying monthly payments while working full-time in those settings, the rest of your federal loans can be forgiven — tax-free.

- Other programs, like the National Health Service Corps (NHSC), offer scholarships or loan repayment in exchange for serving in high-need areas. Start researching these programs now — not three years post-graduation — so you can make career moves that help both your patients and your bank account.

Key Takeaway

You’re working hard to be there for patients — don’t forget to show that same care to your finances. Avoiding common financial aid mistakes can set you up not only to succeed in school, but to build a future that isn’t weighed down by debt. Make time each semester to check your aid plans, explore scholarships, and understand your loans inside-out. The earlier you take control, the more freedom you’ll have to focus on what really matters: becoming the compassionate, skilled healthcare provider the world needs.

If you're already thinking about how to make the most of your financial aid, don’t forget: investing in the right tools now can save you thousands later. Struggling through terminology is one of the fastest ways to fall behind—or even risk failing a course you paid big money to take.

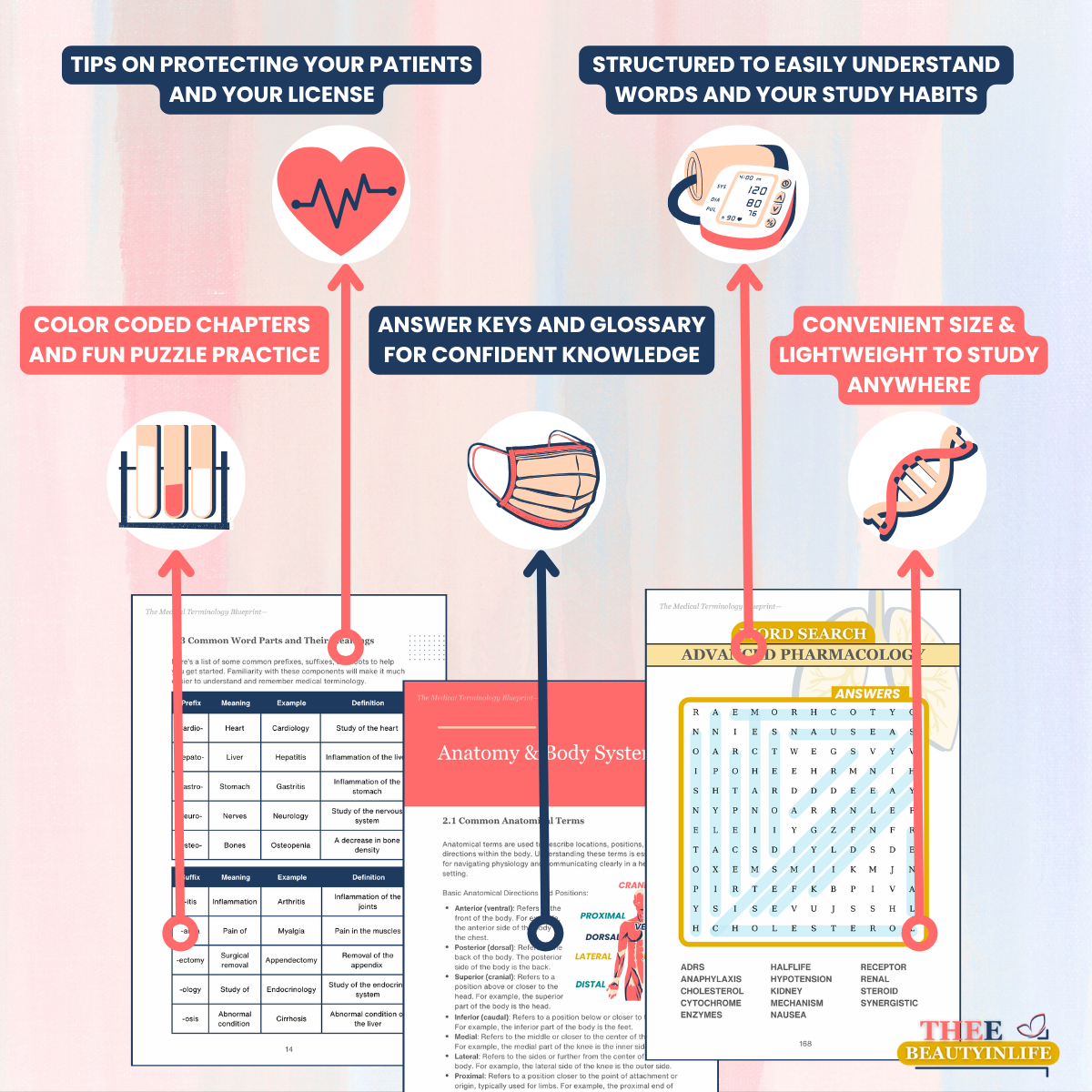

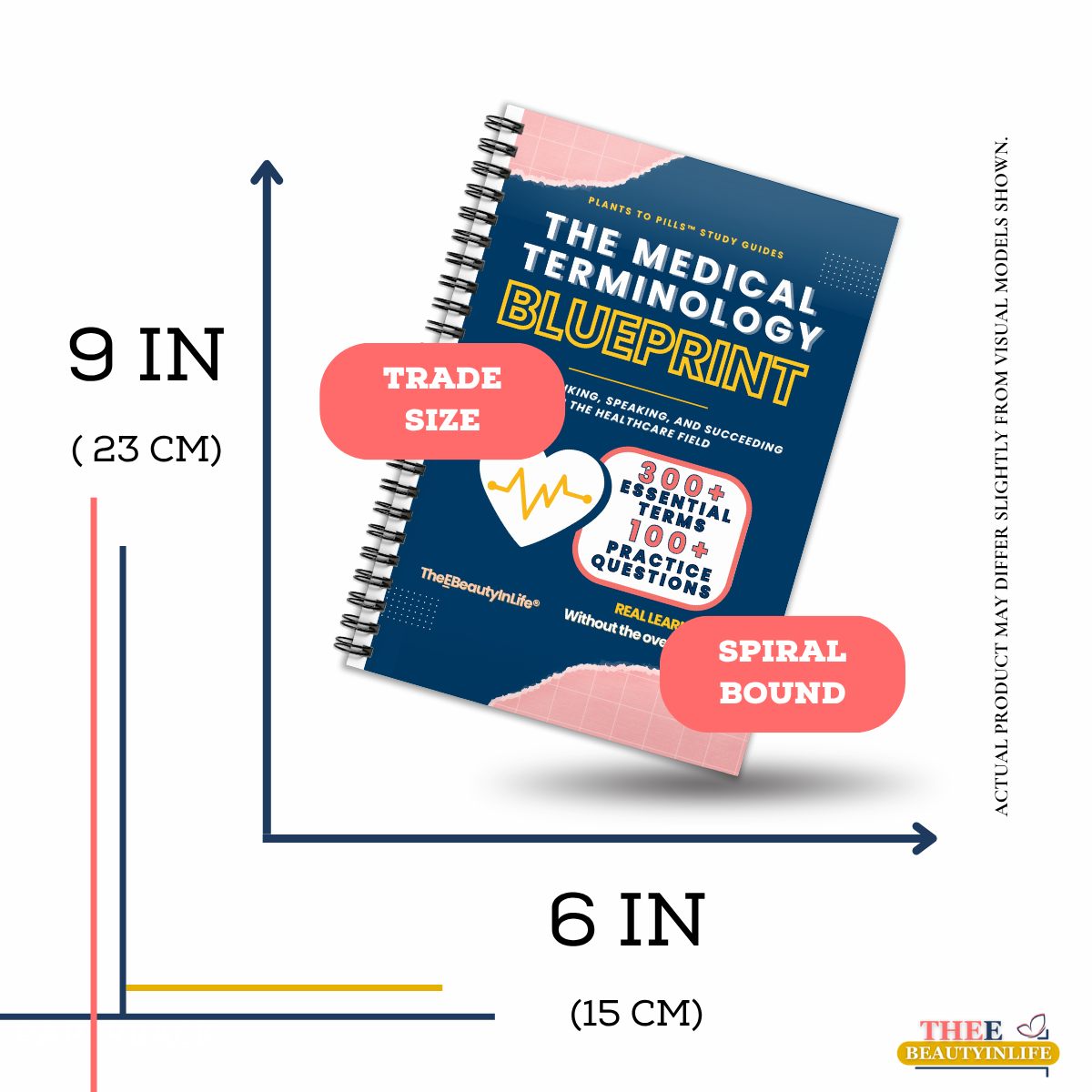

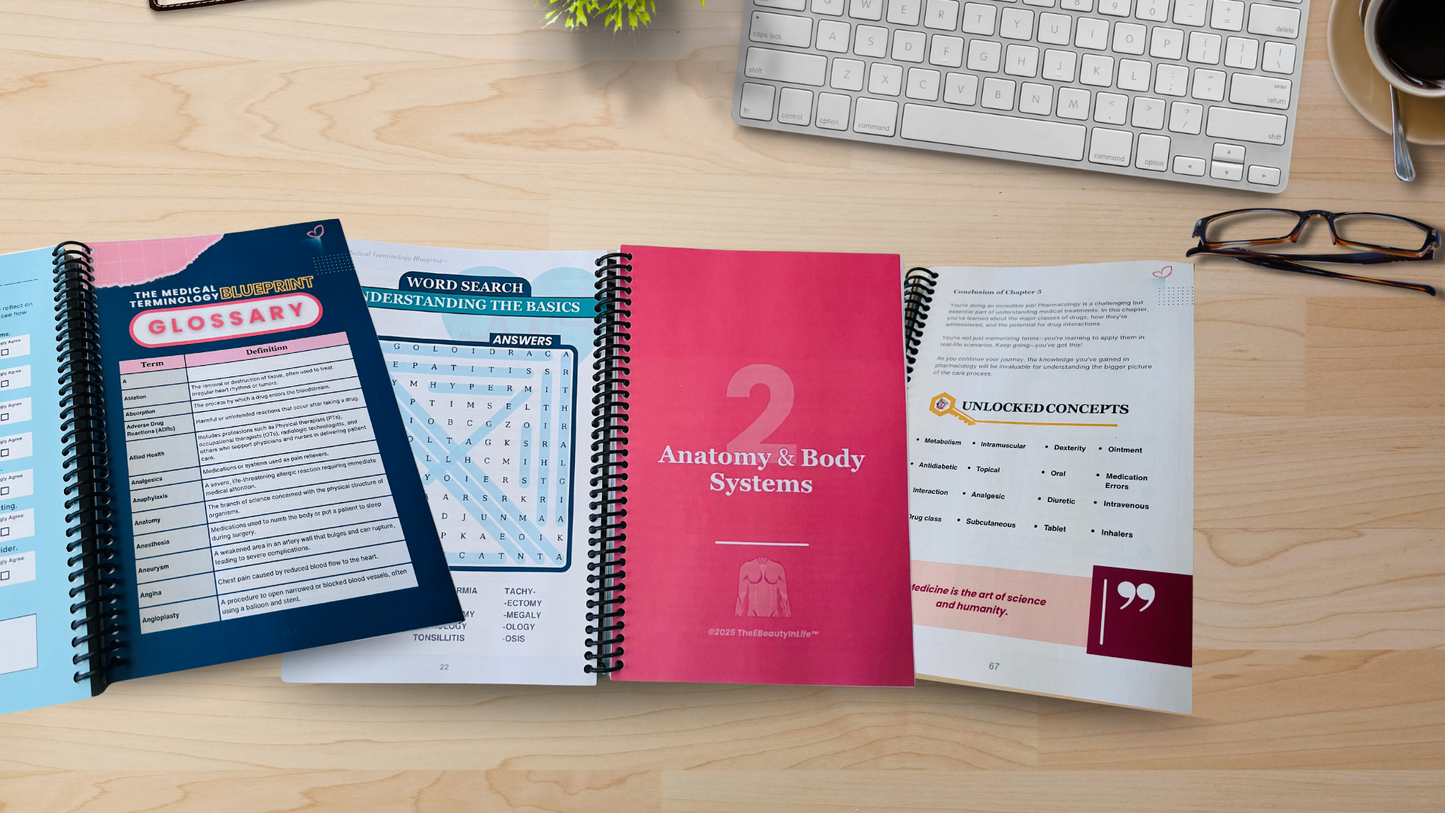

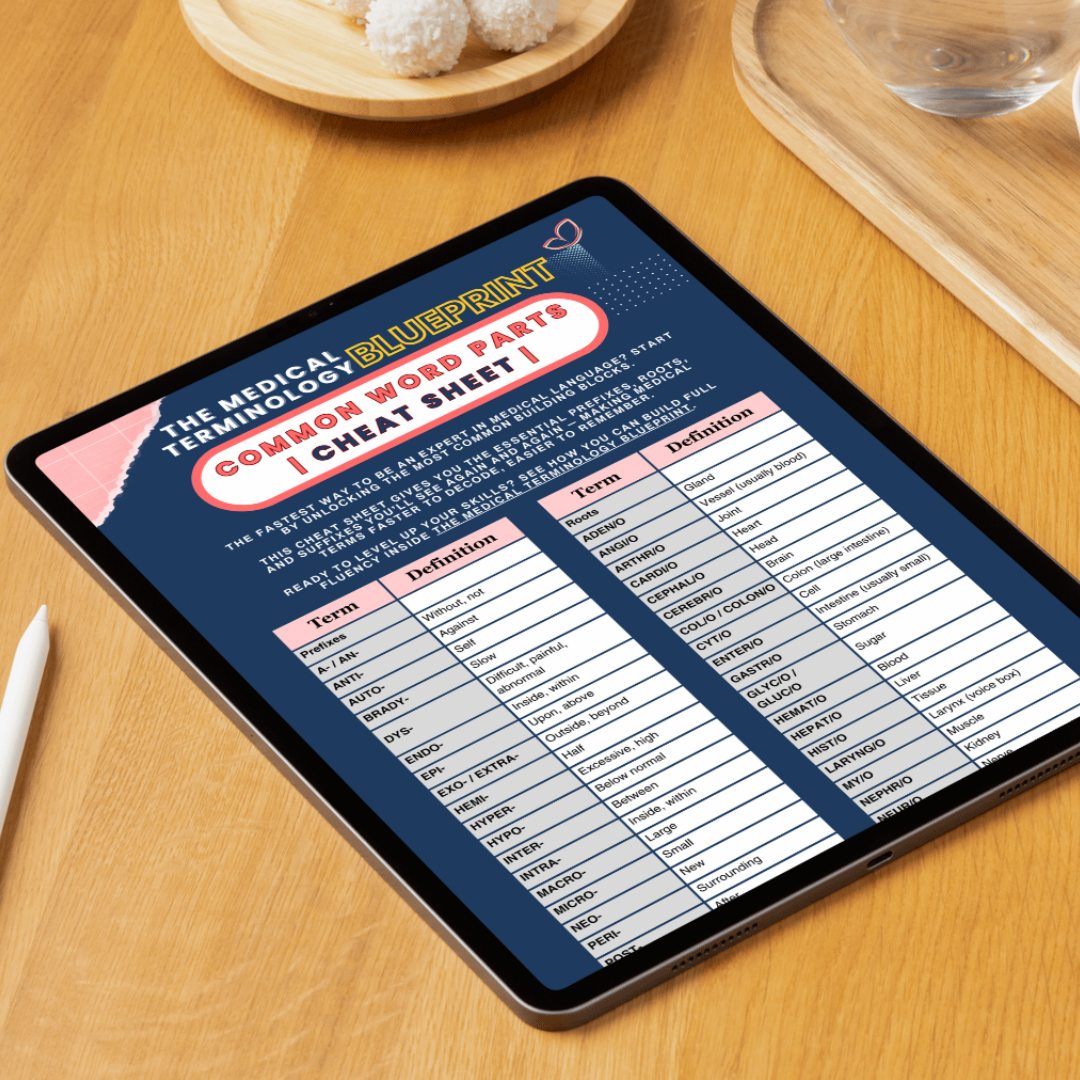

The Medical Terminology Blueprint helps you build a solid foundation from the start, so you’re not wasting time, money, or brain power trying to catch up later.

Ready to protect your self-investment? Grab the workbook here.